The UK sub-contract manufacturing market continued to grow in the first quarter of 2019, despite a continued lack of resolution on Brexit.

According to the latest Contract Manufacturing Index (CMI) figures, business was up 7% in the first three months of 2019 compared to the final quarter of 2018.

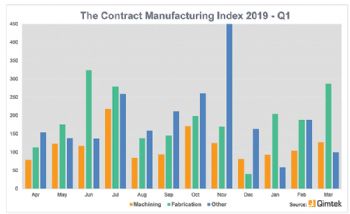

Indeed, there was an upward trend throughout the quarter, compared to the downward trend that had been evident in the last three months of 2018.

Taking a longer-term view, business was also up 6% on the first quarter of 2018 and up by a third since the Brexit vote in the second quarter of 2016; and within the headline figure, there was a surge in business in the fabrication sector, which was up 66% on the previous quarter, while machining dropped back by 14%.

Overall, fabrication accounted for 62% of the value of the market, with machining accounting for 31%; other processes, such as electronics and plastic moulding, accounted for the remaining 7%.

The CMI is produced by sourcing specialist Qimtek and reflects the total purchasing budget for out-sourced manufacturing of companies looking to place business in any given month.

This represents a sample of over 4,000 companies that could be placing business and together have a purchasing budget of more than £3.4 billion, plus a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

The baseline figure of 100 represents the average value of the sub-contract market between 2014 and 2018 (this has recently been re-based to allow more accurate comparisons of current data; it was previously just based on 2014 values).

Commenting on the figure, Qimtek owner Karl Wigart (

www.qimtek.co.uk) said: “The latest CMI figures really demonstrate the resilience and underlying strength of UK manufacturing, as the sub-contract market continues to shrug off the effects of Brexit uncertainty.

"Many sub-contractors are working at full capacity and are even turning work away. The first-quarter results show that the dip in the last couple of months of 2018 was a wobble, and the index has now climbed back to its normal level.”