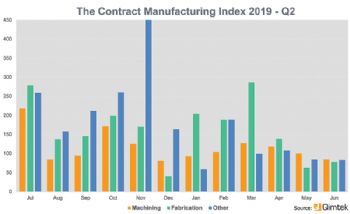

According to the latest Contract Manufacturing Index (CMI), the UK sub-contract manufacturing market has broken its steady upwards trend; it declined by 37% in the second quarter of 2019 (compared to the first).

The CMI fell to 101 — just one point higher than the baseline figure of 100, which represents the average value of the sub-contract market between 2014 and 2018.

This is the lowest it has been since the first quarter of 2015, when the index was first published. Until this quarter, the market had been rising steadily, and it reached a peak of 194 in March this year.

Within the headline figures both machining and fabrication fell sharply, while other processes — including moulding and electronic manufacturing — bounced back slightly in May.

The market was fairly evenly split, with machining representing 43% of the value of contracts placed and fabrication representing 40%.

The CMI is produced by sourcing specialist Qimtek (

www.qimtek.co.uk) and reflects the total purchasing budget for out-sourced manufacturing of companies looking to place business in any given month.

This represents a sample of over 4,000 companies that could be placing business and together have a purchasing budget of more than £3.4 billion, plus a supplier base of over 7,000 companies.

Qimtek owner Karl Wigart said: “The market had been holding up well in the face of uncertainty over Brexit but dropped significantly in April, when the UK had been due to leave the EU. April, May and June all saw a steady decline in the index, with the larger companies simply not sending out projects.

"This was particularly visible in the West Midlands — the heart of the automotive industry.

“This suggests that OEMs had factored a high level of precautionary Brexit stockpiling into their 2019 production schedules and then had to run these stocks down, once the leaving date was postponed.”