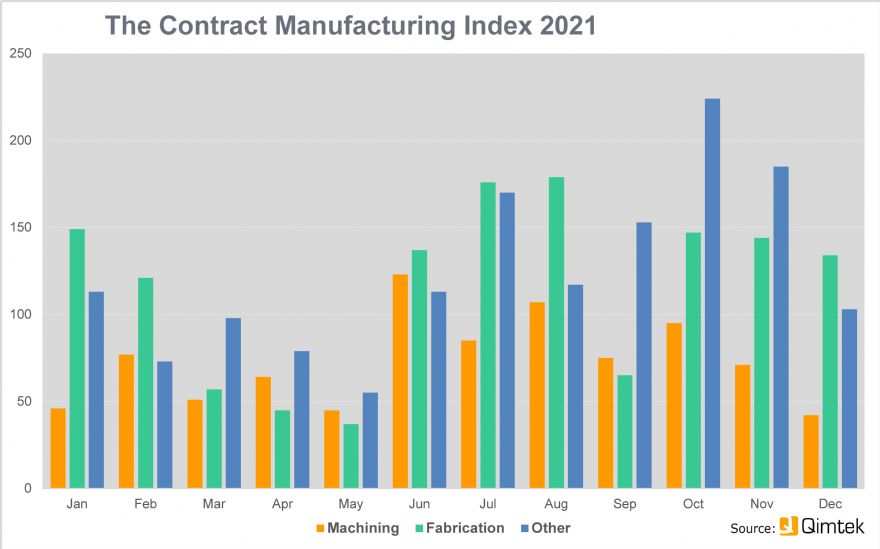

The latest Contract Manufacturing Index (CMI), published by sourcing specialist

Qimtek, shows that 2021 was a volatile year for sub-contractors with large dips in May and September but strong peaks in August and November. Overall though, the result was good, with the market 10% higher on average than the previous year.

The final quarter showed the traditional year-end slump, compounded by supply chain issues, but nevertheless, with a CMI of 110 it was only down 6% on the previous quarter and 64% up on the same period in 2020.

The CMI reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4 billion and a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

The baseline for the index is 100, which represents the average size of the subcontract manufacturing market between 2014 and 2018.

Looking at the final quarter in more detail, there was a steady drop-off in business from October to the end of December — which mirrored the previous year. In 2021 though, the fall in business was more clearly linked to difficulties in sourcing material and rising energy and material costs. There are signs that without these constraints underlying demand would be quite strong.

Across the year, the strongest market sectors were Industrial Machinery, Electronics, Heavy Vehicles/Construction Equipment, Construction and Furniture. Automotive grew strongly in the second half of the year, and was the sixth largest sector by the end of the fourth quarter.

In terms of process, fabrication represented 54% of the sub-contracting market, up from 46% in 2020 and machining represented 35% of the market, down from 39% in 2020.

Qimtek owner Karl Wigart commented: “The index demonstrates what a mixed year it was. While the beginning of the year was more affected by the pandemic, the end of the year was dominated by supply chain issues, shortage of trained staff and inflation worries. In between though, there were peaks of strong activity, suggesting that without these constraints the underlying market remains strong.

“At the moment, many buyers are unwilling to place orders without more visibility on prices and deliveries. Down the line there are even faint indications of a coming capacity crunch. A lot of sub-contractors are working flat out on existing business and it is difficult to add more capacity quickly as machine tool manufacturers are also facing supply chain issues.”