UK car production declined -19.2% in the first six months of the year, according to the latest figures published by the

Society of Motor Manufacturers and Traders (SMMT), with 95,792 fewer vehicles built compared with the same period in 2021.

A total of 403,131 units were built, representing the weakest first half since the pandemic-ravaged 2020 and worse than 2009 when the global financial crisis decimated demand. The main cause remains shortages of key components, most notably semiconductors, exacerbated by additional supply issues caused by the war in Ukraine, as well as significant structural and model changes within the sector.

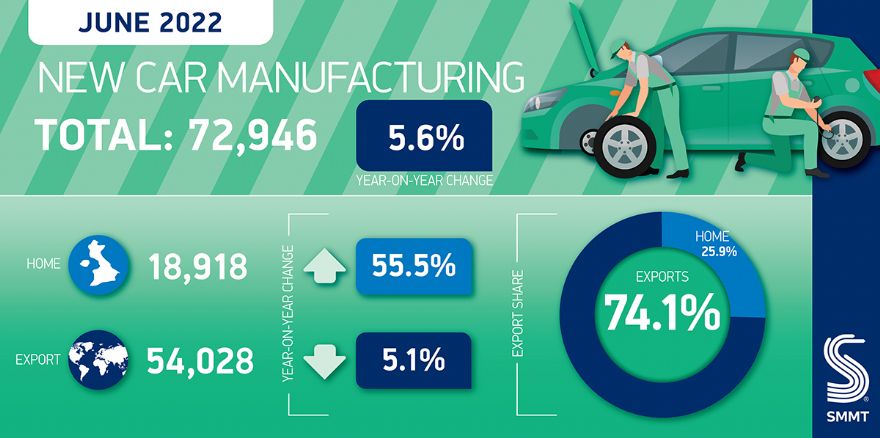

Despite this challenging backdrop, June was the second consecutive month of increasing car production in the UK, up 5.6% with 72,946 units built. Although this was the best June performance since the start of the pandemic, in part due to supply chain shortages beginning to ease, output remains -33.2% below 2019 levels.

The year-to-date decline was driven largely by a fall in export volumes, with -23.9% fewer cars produced for overseas markets during the first half of 2022. This represents a loss of 99,388 units compared with the same period in 2021, despite exports still accounting for 78.6% of all production output.

Significant impactWhile the European Union (EU) was the largest recipient of UK-built cars, accounting for more than 60% of exports, shipments to the bloc decreased by -10.6%. Deliveries to the USA also declined by -56.1% with the closure of a major UK plant in 2021 having a significant impact. Output for the UK market, however, rose by 4.3%.

Production of battery electric vehicles (BEVs) has again proven to be a bright spot for the sector, with 32,282 produced in the first half of the year, an increase of 6.5%. This was bolstered by a 44.2% rise during June resulting in a record output of zero-emission vehicles for the month. Output of hybrid, petrol and diesel cars, meanwhile, declined, by -19.9%, -8.0% and -60.2% respectively in the first half of the year.

The ongoing disruption to global supply chains has led to a downgrading of the industry’s production outlook, with 866,000 cars now anticipated to be built this year. While this represents 1% growth on 2021 volumes, it is 113,285 units below the March outlook, a reflection of the impact of the Ukraine crisis, lockdowns in China and the severity of parts shortages. Output is targeted to improve further in 2023 to 956,575 units, before surpassing one million units by 2025 as supply chain issues recede.

Despite car production decreasing overall this year, significant investment into the UK industry is being made, with more than £3.4 billion announced so far in 2022, primarily for EV production and supply chains. This investment will provide a significant boost to the UK and local economies, creating and safeguarding jobs in a sector that is pivotal to the UK’s ‘net zero’ goal.

Mike Hawes, SMMT chief executive, said: “Car manufacturers have been suffering from ‘long Covid’ for much of 2022, as global component shortages undermine production and put supply chains under extreme pressure. Key model changeovers and the closure of a major plant last year have also impacted output, but there are grounds for optimism with rising output over the last two months.

“As these issues recede over the next year or two, investment in new technologies and processes will be essential but this will depend on our underlying competitiveness. Sky-high energy costs, non-competitive business rates and skills shortages must all be addressed if we are to build on our inherent strengths and seize the opportunities presented by the dash for decarbonised mobility.”

Meanwhile, engine production declined -12.7% in the first six months of 2022, totalling 812,397 units. Year to date output for export fell -9.7%, while production for the UK is down -16.4%.

Mr Hawes added: “The global shortage of semiconductors continues to wreak havoc on the production of vehicles and, in turn, engines, with manufacturers operating in a highly challenging economic environment. To ensure the UK is an attractive place to invest, however, key competitiveness issues such as business costs, not least energy, must be tackled to safeguard the skilled jobs that make a huge contribution to the British economy.”