Shropshire-based GWR Fasteners Ltd, a family-run company that manufactures high-quality special fasteners and precision components, has invested in a new Citizen Miyano BNE-51SY6 eight-axis CNC turning centre with the help of a finance package from long-standing finance partner Close Brothers Asset Finance (

www.closeassetfinance.co.uk).

GWR (

www.gwr-fasteners.co.uk) recently moved into new premises on the Artillery Business Park in Oswestry after outgrowing its former location.

The new bar-fed turning centre will enable it to both ramp up production and offer new products.

Managing director Jude Robinson, who established GWR 10 years ago with her partner Gary, said: “The purchase of the new CNC machine is a strong statement of our ambitions, and it wasn’t a decision we took lightly.

"Having worked with Close Brothers Asset Finance since we started out, we were able to negotiate a deal that worked for both firms, and we are delighted with the outcome.”

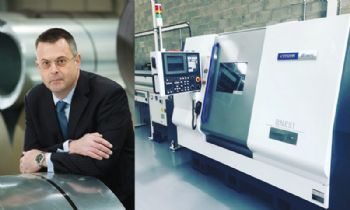

Simon Parker, regional sales manager for Close Brothers Asset Finance manufacturing division, said: “We have been a partner of GWR Fasteners since the firm was established.

"We funded its very first CNC machine, and we are delighted that it selected us as its funding partner for the latest acquisition.

"The bespoke finance package that we compiled will have a negligible impact on the firm’s cash-flow, which is always a key consideration on this type of deal.”