Northampton-based

Bowers Electrical Engineering Services Ltd (BEES) has secured £250,000 from

Maven Capital Partners E&SE Midlands Debt Finance fund, through the

Midlands Engine Investment Fund (MEIF) and backed by the Coronavirus Business Interruption Scheme Loan (CBILS).

The company will be using the funding to purchase new materials and cover labour costs – helping it to deliver two new contracts that the business has recently obtained and create two new jobs.

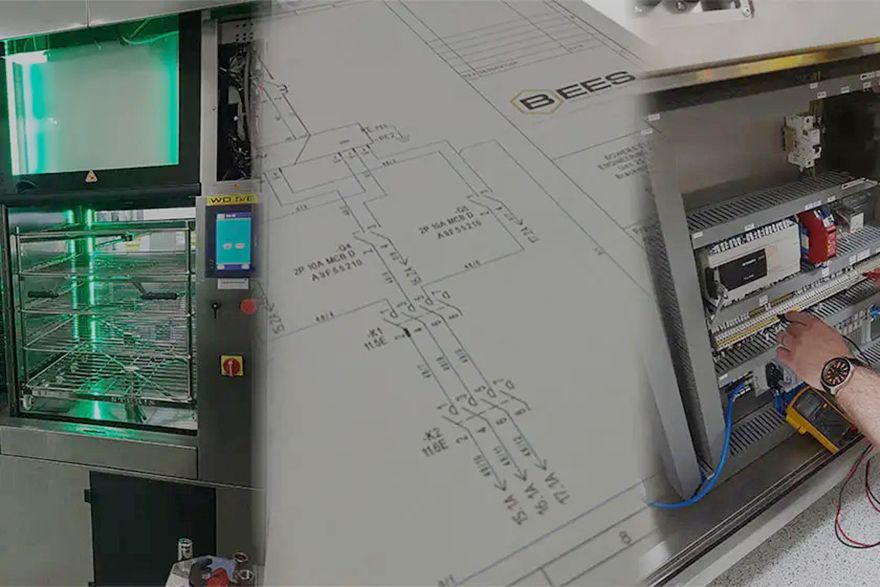

BEES provides electrical engineering services through four key services offerings: validation of decontamination equipment, design and building of specific machinery, control and automation of electrical panels and a customer part distribution service.

The business provides its services to a range of customers within the medical, life sciences and engineering sectors, including the NHS, CIS and Miele Professional. Overseen by managing director Chris Bowers, the company continues to grow as businesses increase their automated machinery and systems investments.

He said: “Following this MEIF funding, we are now in a very strong working capital position, allowing us to spring forward and deliver the next level of our growth trajectory and tender for all sizes of machine control and automation projects.”

Graham Hall, investment manager at Maven said: “It is great to be able to assist Chris with this important Growth Capital Loan to allow the firm to seize upon some great business development opportunities proactively sourced during lockdown. Many thanks also to Barclays which made the introduction upon Chris’s request, showing how the MEIF can bridge gaps for businesses seeking out funding opportunities.”

The Midlands Engine Investment Fund project is supported by the European Union using funding from the European Regional Development Fund (ERDF) as part of the European Structural and Investment Funds Growth Programme 2014-2020 and the European Investment Bank.

The Coronavirus Business Interruption Loan Scheme (CBILS) was managed by the British Business Bank on behalf of, and with the financial backing of, the Secretary of State for Business, Energy and Industrial Strategy (BEIS). The scheme ended on 31 March and has been replaced by the Recovery Loan Scheme.