ThyssenKrupp AG

ThyssenKrupp AG and

EP Corporate Group (EPCG) have agreed on the latter acquiring a 20% stake in ThyssenKrupp’s steel business. In addition, the parties are discussing the acquisition of a further 30% of the steel business by EPCG, the aim being to form an equal 50/50 joint venture.

The companies say the strategic partnership with EPCG, a leading European energy company, is an important step that ‘contributes to a resilient, cost-efficient and climate-friendly steel production at ThyssenKrupp Steel, and therefore also a significant contribution to safeguarding the future of the steel industry in Germany’.

ThyssenKrupp’s chairman Miguel López said: “Our goal is a future concept that leads to economic independence and business success for ThyssenKrupp Steel, meets the requirements of climate protection, avoids compulsory redundancies, and is widely accepted. The cooperation with EPCG demonstrates the confidence of both partners in the successful future of our steel business.

“Together, we want to create a high-performance, profitable and future-oriented steel company that reduces the costs of decarbonisation to a more competitive level and thus accelerates the ‘green’ transformation of the steel industry on the way to CO

2 neutrality. A strong energy partner such as the EPCG is indispensable for this.”

Daniel Křetínský, CEO and majority owner of EPCG, said: “Reaching an agreement on the acquisition of the 20% share in ThyssenKrupp Steel Europe is an initial step on the envisaged path that shall eventually lead towards a bigger leap in the planned strategic partnership. EPCG has successfully navigated dynamic market conditions in the energy sector, while remaining financially strong, growing, and a reliable provider of energy and services to our clients. On this basis, we are convinced that this joint venture concept will establish a more resilient position for ThyssenKrupp Steel.”

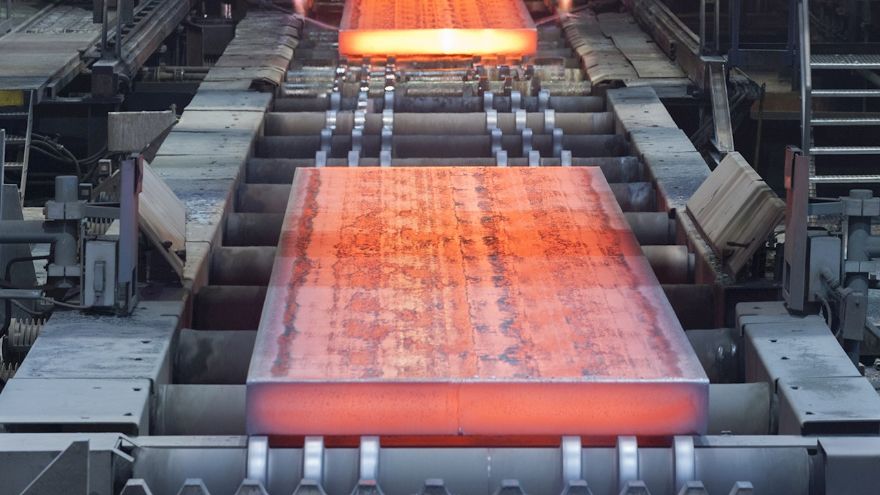

ThyssenKrupp has already taken the first steps towards decarbonising its steel production. In March this year, construction work began on the first hydrogen-capable direct reduction plant with two melters at the Duisburg site. The company is investing around 3 billion euros in the construction of the plant, while the federal government and the state of North Rhine-Westphalia are supporting the total investment in the project with around 2 billion euros.

It says the project is regarded as ‘a blueprint for the decarbonisation of the industry and a change-maker in the European hydrogen economy landscape’, adding that the state-supported switch to hydrogen as the primary energy source for steel production will significantly increase the demand for green electricity in the coming years, with around 10 terawatt hours (TWh) of green electricity being required annually for the first CO

2-neutral direct reduction plant alone.