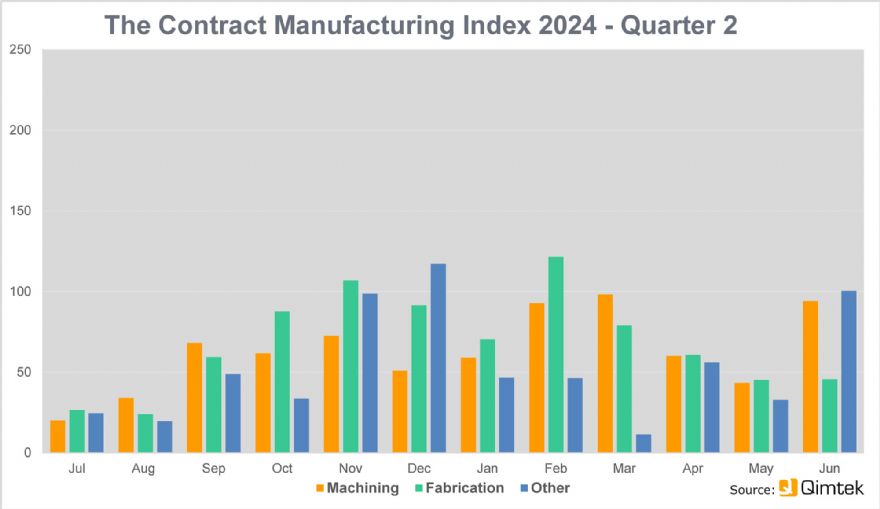

After an encouraging first quarter, the UK sub-contract manufacturing market dropped back sharply in the second quarter of 2024, according to the latest Contract Manufacturing Index (CMI) produced by sourcing specialist

Qimtek. The index dropped by 28% compared to the previous quarter – standing at 59 compared to 82 in the previous three months — 23% down on the same period last year.

While uncertainty over the General Election did not seem to have been a major factor in the decline, the expected Labour win may have buoyed confidence at the end of the quarter. The index which dropped by 28% from March to April, dropped a further 28% from April to May when the election was called. However, from May to June the market rose by 72% so that at the end of the quarter it stood just 10% off the average for the first quarter. Lead times, which have been on a generally downward trend, were at 20 days for April and May, but drifted out to 21 days in April.

The CMI reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4 billion and a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

The baseline for the index is 100, which represents the average size of the sub-contract manufacturing market between 2014 and 2018. Machining accounted for 52% of the market – up from 48% in the previous quarter, while fabrication fell from 49% of the market to 38% of the market. The largest single sector remains Industrial Machinery, which has been the number one sector for the past three years. It was however down significantly on the last quarter – falling by around two thirds.

Analysis by Qimtek shows companies in the Industrial Machinery market average around 70 employees with an average outsource value of £650,000 per year. Marine became the second largest sector, over 10-times its size in the previous quarter, in third place was Food and Beverage, significantly down, while in fourth place Defence/Military more than doubled in size. Hit hardest was the Construction and Electronics sector – which probably contributed to the falling market share for fabrication work.

Qimtek owner Karl Wigart said: “This was not a good quarter with a very slow April and May. June picked up with much better activity from buyers and suppliers, however we are being told again that projects are waiting to be given the go-ahead, partly due to people waiting for the election result.”