The Swiss

Mikron Group, which employs a total workforce of around 1,590 and has two business segments Mikron Automation and Mikron Machining Solutions (these are based in Boudry and Agno, although there are additional production sites in the USA, Germany, Singapore, China, Lithuania, and Italy), has reported preliminary and unaudited net sales of CHF374.1 million for 2024, an increase of 1% compared with 2023. Both business segments showed ‘modest growth’, a fact the Group says demonstrates ‘its resilience in a difficult market environment, particularly in Europe’.

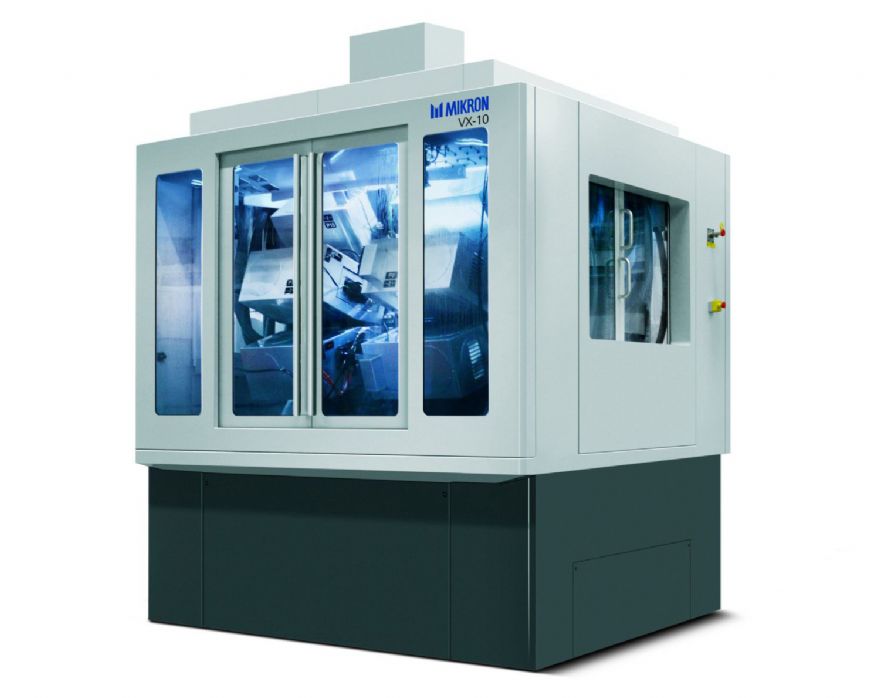

Of this net sales total, Automation contributed CHF233.3 million, an increase of 0.9% with strong growth in Europe offset by a decline in the USA. Machining Solutions increased net sales by 1.2% to CHF140.8 million, which was regarded as a good result given the difficult market conditions, particularly in Europe.

Mikron’s order intake for 2024 was CHF388.6 million, which is a decrease of 5.7% compared to the prior year. Automation contributed CHF265 million, a decrease of 4%, with ‘solid results’ in Europe and Asia offset by a decline in the USA. Machining Solutions ended the year with an order intake of CHF123.7 million, a decrease of 9.1% that reflected a general weakening of the market in Europe, albeit a growing one in the USA. As Mikron entered 2025 it had a ‘healthy order backlog’ of CHF324.1 million. This is an increase of 6.5% compared with the prior year.

For the 2024 financial year, Mikron expects an operating profit margin of around 8.5%; this compares with 9% for 2023. Mikron will announce the Group’s detailed figures for 2024 on 7 March 2025.