Against a traumatic background of the Covid-19 pandemic and Brexit worries, the sub-contract manufacturing market showed some resilience, with the Contract Manufacturing Index (CMI) for the final quarter of 2020 (Q4) at 67, compared to 66 for Q4 2019.

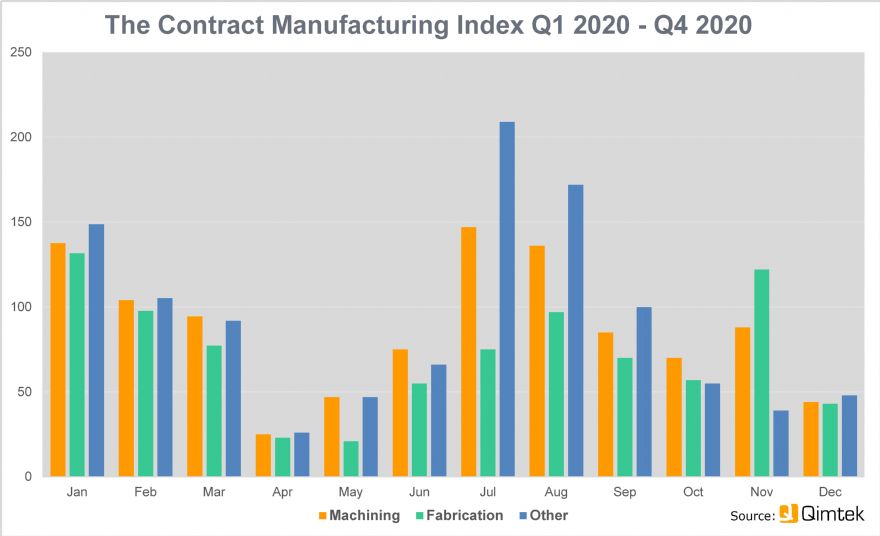

However, these figures conceal a ‘tumultuous and volatile’ 12 months. Although there was a strong start to the year, this was followed by a dramatic fall at the start of the March lockdown; and while a strong recovery followed in the summer, activity fell back again from September.

The final quarter of 2020 was significantly down overall, with the CMI falling by 46 from 123 in Q3. The average quarterly CMI in 2020 was 88, compared to 104 in 2019.

The CMI is produced by sourcing specialist

Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents: a sample of over 4,000 companies that could be placing business and together have a purchasing budget of more than £3.4 billion; and a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

The strongest fall in Q4 was in fabrication, dropping from 58% of the total market to just 31%, and appearing to be linked to a slowdown in construction. From being the most important sector in Q3, construction was down 71% in Q4 and fell to seventh place.

The biggest sectors in Q4 were industrial machinery, electronics, heavy vehicles/construction equipment and medical/scientific. Of these, only heavy vehicles/construction equipment and medical/scientific showed any significant increase in value. Food and beverage, marine and furniture all saw big falls.

Qimtek’s owner Karl Wigart said: “Comparing the figures with previous years it looks very bleak but considering we were in lockdown for a quarter of the year it looks pretty good. Q4 was slow to start and did well in November but reverted to a slow December again, same as last year.

“A lot of projects are being slowed down for various reasons and the most common we hear of are communication, uncertainty and material and transport shortages.”