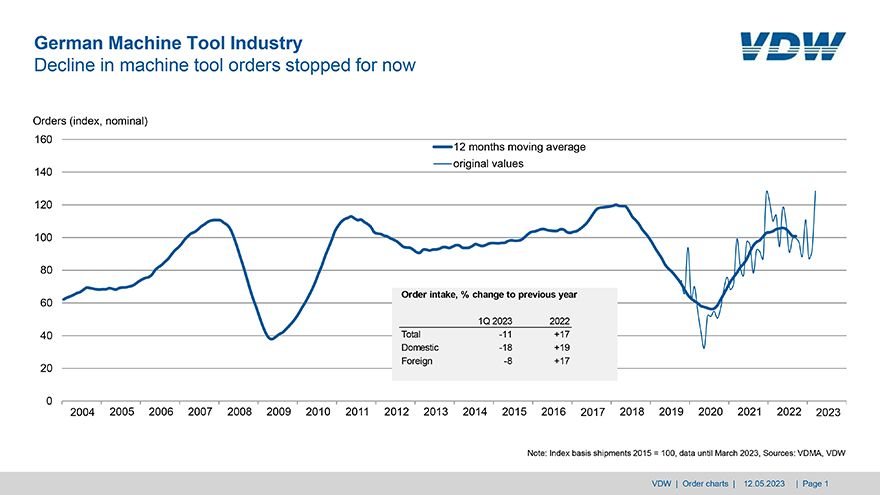

Orders received by the German machine tool industry in the first quarter of 2023 were 11% down in nominal terms on the same period last year. Orders from Germany declined by 18% whereas those from abroad fell by 8%. Overall, this represents a decline of 17% in real terms.

Dr Wilfried Schäfer, executive director of the

VDW (German Machine Tool Builders' Association), said: “Given the many financial burdens — such as the energy crisis, high inflation, increased interest rates and the overall weakness of the economy — it is encouraging to note that the latest figures from March show a halt in the downward trend in orders.” He added that orders from abroad are proving much more stable than those from the domestic market. Impetus is coming in particular from the non-euro countries, where large-scale orders are playing an important role.

Mr Schäfer continued: “Overall, we are seeing a decline in the difficulties which our industry has had to contend with.” China has ended its zero-Covid-19 policy. Supply chain tensions are now beginning to ease and this is allowing key customer sectors such as the automotive industry to produce more again — this had suffered above all from the lack of microchips. As a result, sales picked up again in the first quarter. The increase of 20%, or 11% in real terms, reflects the positive factors.

Regardless of the current economic situation, numerous developments are leading to raised levels of investment: the ongoing trend toward automation, increasing digitalisation, booming electromobility, the build-up of capacity in the critical infrastructure triad (for example, chips, and batteries), extensive investment in climate protection (e.g. heat pumps), the expansion of renewable energy sources, and rising defence spending.

Mr Schäfer concluded: “We are expecting orders to stabilise in the second half of the year.” A major advantage right now is the ongoing and sizeable backlog of orders stretching ahead almost 12 months. According to the latest forecast, this will enable production to grow by the same amount in 2023 as in the previous year — a 10% increase to 15.5 billion euros.