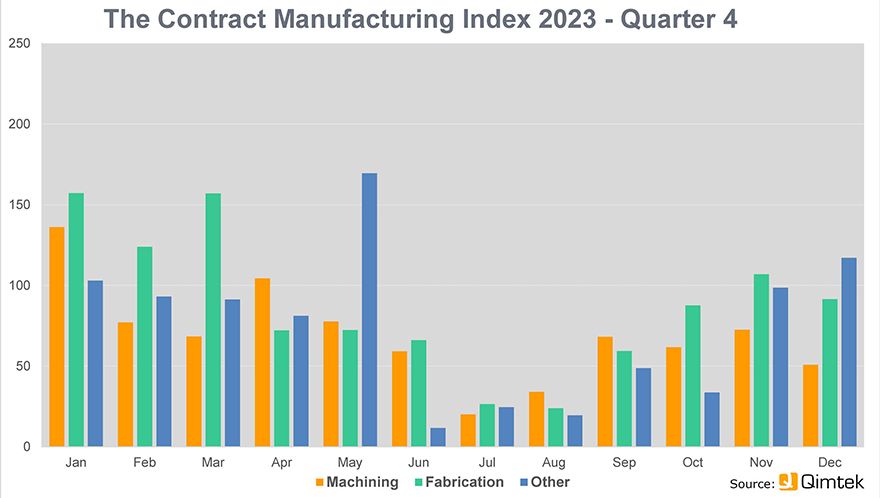

The latest Contract Manufacturing Index (CMI) shows that the UK market for sub-contract manufacturing ended 2023 on a strong positive note after experiencing a very difficult year. Performance during the period was driven down by buyers putting new projects on hold and focusing on reducing stock in response to uncertain demand — it reached an all-time low in August.

The rebound in the fourth quarter was impressive, with the market up 106% compared to the previous three months as purchasing organisations unlocked budgets and started to place new work with suppliers. Overall the market ended the year 7.5% higher than at the end of 2022.

The CMI is produced by sourcing specialist

Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies who could be placing business that together have a purchasing budget of more than £3.4 billion and a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

The baseline for the index is 100, which represents the average size of the sub-contract manufacturing market between 2014 and 2018. The CMI for the fourth quarter of 2023 was 78.5, compared to 38.1 in the third quarter 2023 (73 in the third quarter of 2022). Over the course of the year the market got off to a strong start in January but quickly tailed off to hit new lows in July and August. A recovery then began in September and carried on picking up momentum for the rest of the year.

On a process-by-process basis, fabrication was the strongest area of the market — up 160% on the previous quarter and 12% on the previous year. Growth in machining was less strong but still significant — up 51% on the previous quarter but just 2.4% up on the previous year. Other processes including moulding and electronic were up by just 0.5% year-on-year. The largest single sector throughout the year was ‘Industrial Machinery’, with ‘Food & Beverage’ second and ‘Electronics’ third. Qimtek is now also tracking average lead time, which stayed consistent throughout the year at 22 days.

Qimtek owner Karl Wigart commented: “The main reason that 2023 was a slow year was that a lot of new projects were being kept on hold and buyers were concentrating on using up their existing stock. It seems as if the optimistic view we had at the end of the third quarter was justified and the fourth quarter did see a good rebound of activity among both buyers and suppliers. Buyers suddenly started to release new projects and suppliers picked up on the quoting activity from the third quarter. This trend seems to be set to continue and the start of this year has been surprisingly busy.”