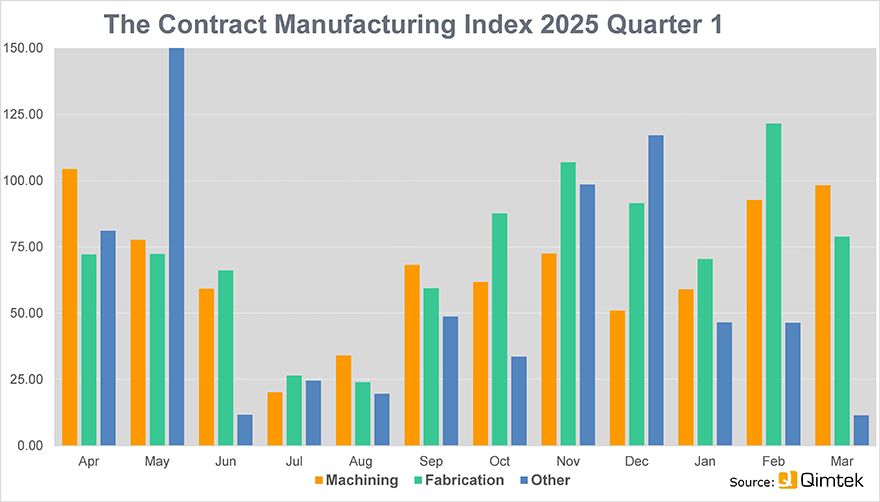

The Contract Manufacturing Index shows the value of the market for contract and sub-contract manufacturing services for machining, fabrication and other processes

The Contract Manufacturing Index shows the value of the market for contract and sub-contract manufacturing services for machining, fabrication and other processes The latest Contract Manufacturing Index (CMI) shows that the sub-contract market rebounded in the first quarter of 2025 — up almost 50% on the final quarter of 2024. January was particularly strong — 200% higher than what had been a very quiet December. Over the course of the first three months on the year the market dropped back — possibly because of caution ahead of the National Insurance and minimum wage increases that were due to come into force in April with the start of the new tax year.

Nevertheless, the market at the end of March was still higher than the average for the final quarter of last year. There is still room for improvement though as the market is still 22% down compared to the same period in 2024. The CMI is produced by sourcing specialist

Qimtek and reflects the total purchasing budget for outsourced manufacturing of companies looking to place business in any given month. This represents a sample of over 4,000 companies that could be placing business that together have a purchasing budget of more than £3.4 billion and a supplier base of over 7,000 companies with a verified turnover in excess of £25 billion.

Strong performance for moulding and electronic assemblyThe baseline for the index is 100, which represents the average size of the sub-contract manufacturing market between 2014 and 2018. The CMI for Q1 2025 was 64 compared to 42.5 for the previous quarter and 82 in Q1 2024. Within the overall figure, machining accounted for 42% of the market, while fabrication accounted for 44%. Other processes, including moulding and electronic assembly accounted for 11% of the market — an unusually high proportion. There was no obvious reason for this.

The largest single sector remains industrial machinery, which has been the number one sector for more than 3.5 years. The second largest market was communication equipment, followed by construction, electronic products and defence/military. Markets that have dropped out of the top five compared to the previous quarter include marine, consumer products and heavy vehicles, although the low levels of activity in that period mean that comparisons are not necessarily significant. Lead times dropped when the market was busy, but increased when there was less activity.

Qimtek owner Karl Wigart concluded: “It is good to see that the market is up on the previous quarter. We saw a lot of activity from buyers and suppliers in January and February but a steep drop-off in March, which is usually a busy month. It remains to be seen what effects President Trump’s tariff flip-flops will have on business confidence in the next few months.”