At the close of its 2024/25 fiscal year on June 30, 2025, the

Trumpf Group reported a notable downturn in performance, with revenue falling 16% to 4.3 billion euros, down from 5.2 billion euros the previous year. The order intake showed a more moderate decline of 7%, settling at 4.2 billion euros compared to 4.6 billion euros in 2023/24.

Earnings before interest and taxes (EBIT) dropped sharply to 59 million euros, a significant fall from the previous year’s 501 million euros. This decline was attributed not only to reduced revenue but also to structural changes within the company. The EBIT margin followed suit, slipping to a disappointing 1.4% from 9.7%. However, when adjusted for these structural measures, EBIT stood at 230 million euros, with a more respectable margin of 5.3%.

Presenting the annual results in Ditzingen, Trumpf CEO Nicola Leibinger-Kammüller acknowledged the challenges faced over the past year. She said: “The slowing global economy and geopolitical uncertainties have led to continued significant restraint in new investments among customers worldwide in the past fiscal year. Nevertheless, we believe that we have now reached the lowest point. We are seeing cautious signs of improvement. For example, our order intake has not decreased for several months and is stabilising at a level that is still undeniably too low.”

Areas of pontential growthLooking ahead to the 2025/26 fiscal year, Leibinger-Kammüller highlighted areas of potential growth. “These include, for example, electromobility, semiconductors, and electronics, as well as our smart factories and services in the machine tools sector. Overall, it is to be expected that many customers will renew their machinery after a long period and will also take advantage of our offerings in the areas of networked manufacturing and artificial intelligence (AI).”

In response to the evolving geopolitical landscape, Trumpf has made a strategic decision to offer technologies for defence applications. This move, made after extensive internal discussions, is contingent on the condition that such technologies remain strictly defensive and are not directed against individuals. Talks are currently underway with industrial partners in Germany to define the scope and implementation of these solutions.

Germany remained Trumpf’s largest single market, generating 700 million euros in revenue, though this marked a 15% decline from the previous year’s 824 million euros. The US market also contracted, with revenue falling 17% to 661 million euros. In China, Trumpf’s largest Asian market, revenue dropped 22% to 482 million euros.

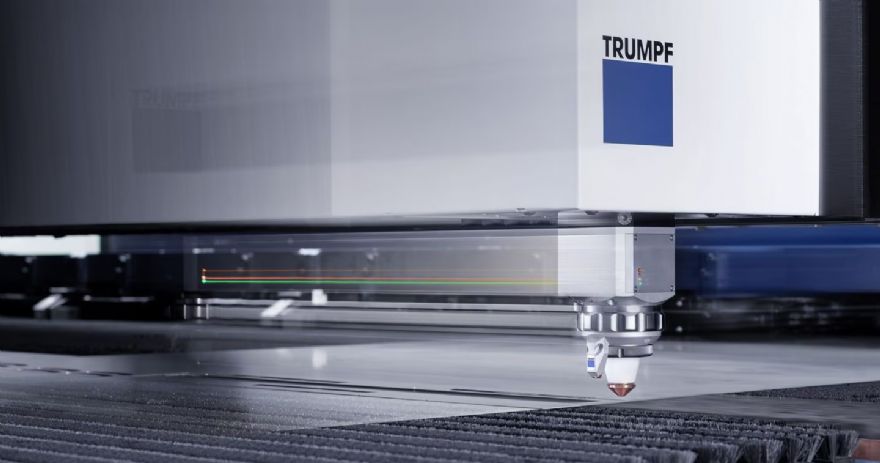

Among its business divisions, Machine Tools led with 2.4 billion euros in revenue, down from 2.8 billion euros. Laser Technology followed with 1.2 billion euros, a decrease from 1.4 billion euros when adjusted for the Electronics division. The Electronics division itself posted 442 million euros in revenue, a 23% decline from 572 million euros. The EUV division mirrored this trend, also falling 23% to 724 million euros from 943 million eruos.

As of the end of June, Trumpf employed 18,303 people globally, a slight decrease from 19,018 the previous year. In Germany, the workforce shrank by 1.8% to 9,337, with 5,907 based at the company’s headquarters in Ditzingen and other nearby locations. The company maintained a strong commitment to training, with 613 young people completing apprenticeships or co-op programmes, raising the training ratio to 3.1%.

The impact of Trumpf’s structural measures had not yet significantly influenced staffing figures by the end of the fiscal year. In research and development, the company employed 3,006 people, down slightly from 3,087. R&D spending remained robust at 519 million euros, close to the previous year’s 530 million euros. This brought the R&D-to-revenue ratio to 12%, up from 10.3%, keeping Trumpf well above the industry average.