Nearly two-thirds of firms involved in the metal sector believe the Government’s current trade policies hamper competitiveness, according to new findings. It is one of the major outcomes of the third annual

UK Metals Council’s State of the Metals Industry in the UK 2025/26 report, which revealed a complex picture of current trading conditions for firms involved in this critical industry.

Of the 150 companies questioned, 52% called on access to more financial incentives and support to help them adapt to market and regulatory changes, while a similar figure wanted to see enhanced support from Whitehall for skills and training. A revised relationship with both the European Union (EU) and the USA is still seen as crucially important by more than a third of respondents.

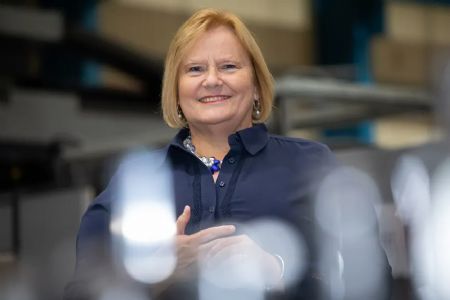

Rachel Eade (pictured below), chair of the UK Metals Council, explained: “The resounding message from this year’s survey is that our sector continues to feel the impact of global uncertainty and UK political instability. This is compounded by rising regulatory burdens, uncompetitive energy costs, an ageing workforce, and an apprenticeship system in need of urgent reform.

“The feedback mirrors the reality I witness firsthand on factory floors and at industry gatherings across the UK and the message is clear — our sector needs more specialist support from Government and acceleration of the Industrial Strategy.

“We will use the findings to lobby Ministers for greater support, and, with this in mind, we have published seven key asks. These include closing the metals skills gap, delivering energy cost competitiveness, securing frictionless trade and ensuring proportionate and predictable regulation.”

Greater assistanceShe continued: “Our sector wants greater assistance on decarbonisation, efficiency and innovation, while championing the importance of critical raw materials and secondary metals. There is also unanimous support for the introduction of a Minister for Manufacturing.”

The UK is home to over 24,000 steel and metal manufacturing companies, employing one million people across a wide number of sectors. Metal products continue to play an increasingly critical role in everyday life, from medtech, and advanced engineering to retail and defence, not to mention forming key components of the Government’s investment in homes and transport schemes.

Now in its third year, the State of the Metals Industry in the UK report offers the most comprehensive and up-to-date analysis of the sector and is based exclusively on feedback from across all levels of the supply chain, including SMEs, OEMs and primes.

Ms Eade added: “Despite all the changes we face, there is a unique resilience in metals companies, and this is reflected in some of the more positive findings. There has been a 50% increase in the number of firms seeking new international markets or partnerships, with around a fifth exploring opportunities from new UK trade agreements and a quarter diversifying to reduce the effect of leaving the EU.”

She concluded: “Even in a difficult demand and cost environment, our manufacturers have continued to invest in technology to enhance productivity and reduce costs, as well as streamlining their ability to trade overseas and move their businesses towards ‘net zero’.”