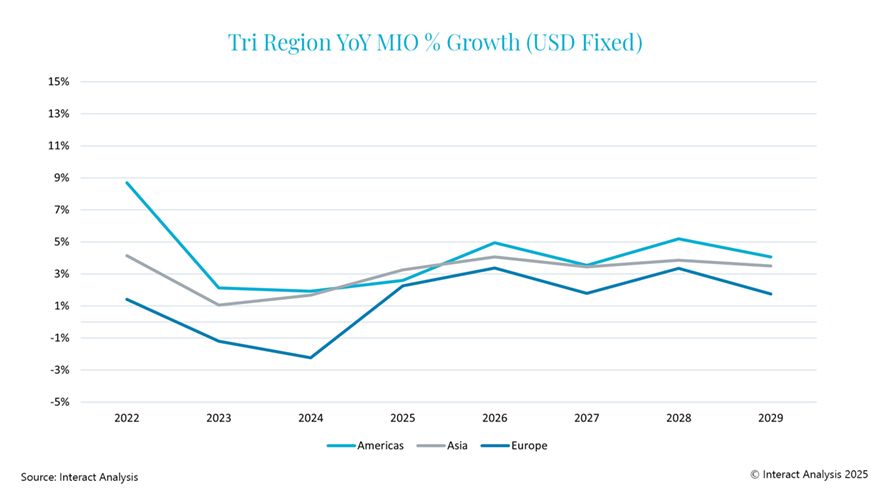

Growth is forecast from 2025 to 2029 for the global manufacturing sector in Europe, Asia, and the Americas regions

Growth is forecast from 2025 to 2029 for the global manufacturing sector in Europe, Asia, and the Americas regionsGlobal machinery production contracted by 2.1% during 2024, according to the latest figures published by

Interact Analysis. This pattern of decline is anticipated to continue into early 2025, but the market is expected to turn a corner by the halfway point of the year, with annual growth of 3% projected, the market intelligence specialist’s

Manufacturing Industry Output (MIO) Tracker has revealed.

Looking at manufacturing production as a whole, the outlook for 2025 is more uncertain than in recent years. This is in part due to the Trump presidency in the USA and the introduction of trade tariffs. In addition, the deterioration in performance of industrial giants in Europe and the artificial intelligence (AI) arms race have the potential to cause sizeable fluctuations in growth across industries and regions. The global manufacturing industry has similar projected growth to the machinery sector, showing a significant dip in 2024 followed by steady growth in 2025 through to 2029.

The growth forecast for the manufacturing industry is lower in many of the larger regions than it has been historically and Interact Analysis has reduced its long-term outlook for the sector across several key regions such as Germany and Japan; and having reviewed its predictions for emerging regions in Asia as ‘too aggressive’ have consequently revised these down. Meanwhile, projections for Europe have also been lowered due to the current economic stagnation. On the other hand, the outlook for US production has become more positive due to the expected impact of the Trump administration’s business-friendly policies.

Deflationary pressuresDespite the global decline in 2024, China’s manufacturing industry still managed to record growth of 1.2%. Although it is positive year-on-year, it marks a very weak period for China’s manufacturing industry compared with its historic growth. China faced major challenges throughout 2024, including weak domestic demand, excess production capacity, and intense price competition. Despite these challenges, the Chinese manufacturing economy started to improve in the fourth quarter and, therefore, the forecast for 2025 has been increased. The recovery is expected to be gradual, but stronger growth is anticipated in 2026 and beyond, although factors such as low profit margins for Chinese manufacturers and a potential trade war could further intensify deflationary pressures.

As a whole, Europe is expected to struggle due to high energy costs, self-imposed environmental targets, and rising labour costs. For example, Germany and the UK are seeing minimal growth and are struggling to compete globally. De-industrialisation is a major concern for Germany, as German automotive manufacturers announced plant closures and mass lay-offs, severely impacting the European manufacturing industry.

On a more positive note, the USA showed resilience in 2024, with growth of 2.7%. However, there are barriers that could hamper economic growth in the future, such as the wide-ranging tariffs currently being implemented by the Trump administration and the likelihood of retaliation from countries with tariffs levied against them. In this scenario, industries which are reliant on components or non-US goods will see costs increase. Despite these concerns, there is optimism for US manufacturing, as the Trump administration has made it clear that growing America’s economy is a top priority, with policy decisions taken to reflect this stance.

Jack Loughney, lead analyst for the MIO Tracker at Interact Analysis, concluded: “Machinery production had a difficult 2024 but the outlook for 2025 is much brighter. The sector shrank by 2.1% overall in 2024, but this is projected to be offset by more moderate growth of 3% in 2025. The malaise of 2024 will continue into the start of 2025, but we expect the sector will have turned the corner by the halfway point in the year.”