UK car production fell in August, breaking a two-month growth run, according to the latest figures published today by the

Society of Motor Manufacturers and Traders (SMMT). 37,072 units rolled out of factories in what is traditionally the quietest month of the year, with planned summer shutdowns taking place to enable maintenance and re-tooling. The figures come before the cyberattack on the UK’s largest automotive employer, the effects of which will likely be evident in September's performance.

Continuing the recent trend, commercial vehicle (CV) production also declined, by -73.2% to 1,621 units, driven by the consolidation of manufacturing operations at a major manufacturer. Combined UK vehicle production was, therefore, down -18.2% in August to a total of 38,693 units, the weakest performance since 1956 and illustrating the challenging environment facing UK automotive manufacturers, with soft conditions in the sector’s largest market, the EU, significant cost pressures, model transitions and slow economic growth.

Car production for the UK market rose by 11.5% to 7,162 units but was not enough to offset a -14.2% fall in exports. 29,910 cars were made for overseas customers in August – representing 80.7% of output.

While overall car output fell, electrified car production rose by 40.9% to 16,830 units, with hybrid, plug-in hybrid and battery electric vehicles accounting for almost half (45.4%) the units produced in August – the second-best share of output for any single month. In the year to date, factories have turned out more than 200,000 of these vehicles, up 3.7% on 2024, although total car output is down -5.9% to 492,009 units. CV output year-to-date, meanwhile, is down -54.4% to 35,922 units.

Likely impact of cyberattackMike Hawes, SMMT chief executive, said: “August is always a low volume month due to planned summer maintenance, but the focus is now on September's performance, and the likely impact of the cyberattack at Britain’s biggest automotive employer. Given this incident and the industry’s importance to jobs, growth and trade, rapid delivery of the Industrial Strategy and Drive35 is now critical. The sector is resilient, but SMMT is engaged with members and the government to understand what additional supportive measures may be needed.”

The news follows the recent publication of SMMT’s latest trade report,

Unmarked Routes: Britain’s Pathway to Stronger Automotive Trade, which shows that, despite an onslaught of challenges, the UK sector remains a global trading powerhouse on course to generate more than £110 billion in trade for the third year running, supporting 796,000 jobs and turning over £92 billion.

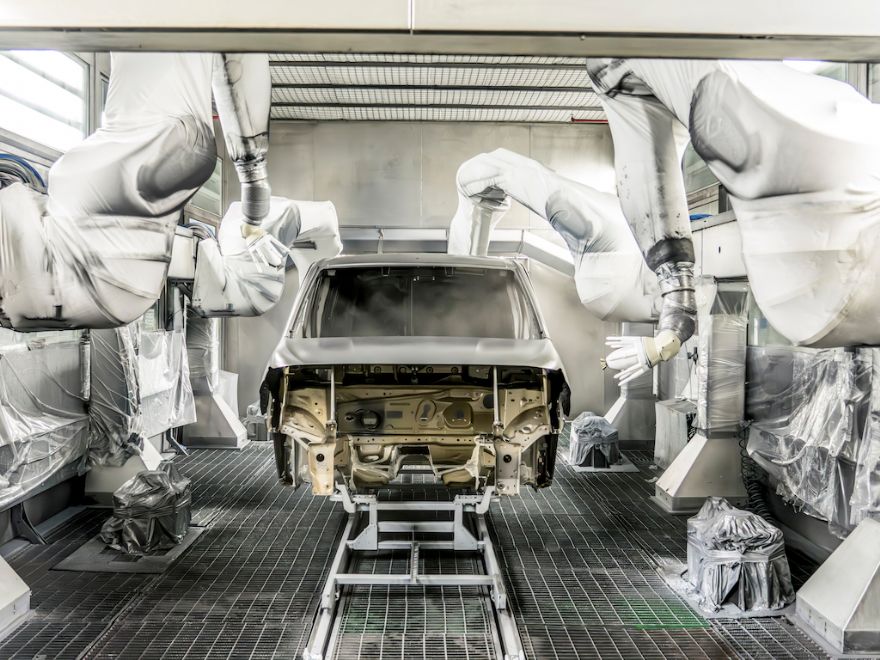

British manufacturers produce not only cars, vans, taxis, trucks, buses and coaches, but also specialist and off-highway vehicles. They are supported by more than 2,500 component providers and some of the world's most skilled engineers, and invest around £5 billion each year in R&D. With notable footprints in the West Midlands, North East and North West, the sector also supports thousands of jobs in adjacent industries – including advertising, chemicals, finance, logistics and steel.